Nodal Newsletter | June 2021

Nodal Highlights

NODAL ENVIRONMENTAL ACCOMPLISHMENTS IN MAY

- Nodal achieved record open interest in environmental futures with 140,000 lots during May.

- Nodal’s total volume traded topped 300,000 lots since the launch of our environmental markets in November 2018.

- Open interest across PJM based REC futures rose to just under 90,000 lots on Nodal.

- In May, four environmental contracts listed on Nodal traded for the first time:

- Oregon Clean Fuels Program futures

- M-RETS® Renewable Energy Certificates from Center for Resource Solutions (CRS) Listed Wind Energy Facilities futures (M-RETS® Wind futures)

- New Jersey Class II REC futures

- Texas Compliance RECs from CRS Eligible Listed Facilities options

NODAL EXPANDED ENVIRONMENTAL CONTRACTS SUITE

Nodal Exchange and IncubEx successfully launched new nitrogen oxides (NOx) futures and options and extended vintages on two Texas voluntary renewable energy certificate (REC) contracts on June 1.

NODAL ELECTRONIC TRADING

Nodal Exchange offers electronic trading in power, natural gas, and environmental products. The Nodal T7 Trading Platform can be accessed via industry leading web-based trading applications: CQG, Trading Technologies and Trayport. Please contact Nodal’s Account Management team with any questions

Nodal and IncubEx expand environmental suite with new EPA cross-state air pollution rule contracts

Nodal Exchange and IncubEx today announced the successful launch of new nitrogen oxides (NOx) futures and options, plus extended vintages on two Texas voluntary renewable energy certificate (REC) contracts.

The new physically delivered NOx contracts are based on the US Environmental Protection Agency (EPA) Cross State Air Pollution Rule (“CSAPR”) Transport Rule (TR). Nodal will list:

- NOx Ozone Season Group 2 Allowance Futures and Options (Vintages 2020 through 2024)

- NOx Ozone Season Group 3 Allowance Futures and Options (Vintages 2021 through 2024)

Under CSAPR, the EPA established rules that limit summer season NOx emissions from power plants in 22 US states. The CSAPR update of March 15, 2021 established new rules to further reduce NOx emissions from power plants in 12 states and transferred those states from the Group 2 requirements to a new Group 3. The remaining 10 states continue to be limited by their existing Group 2 budget levels.

Nodal offers access to electronic markets

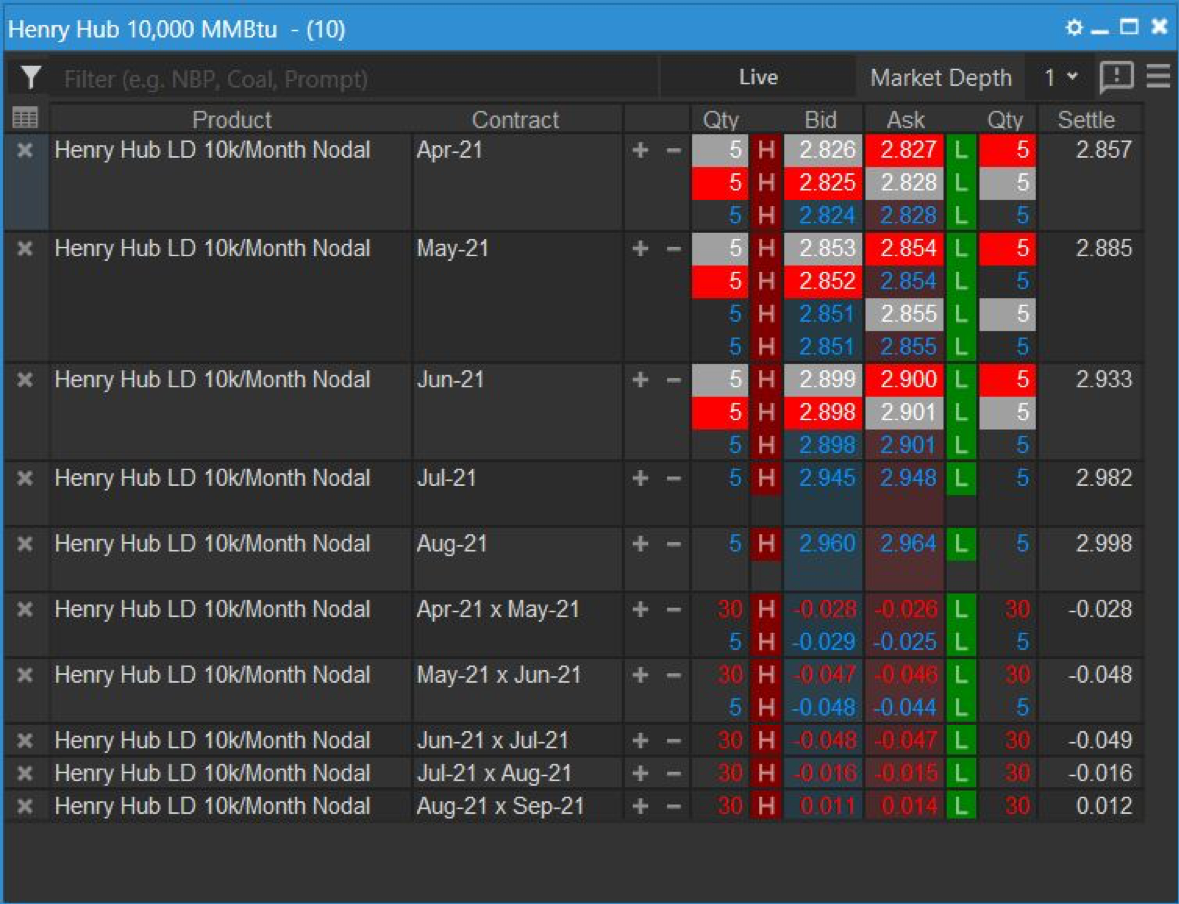

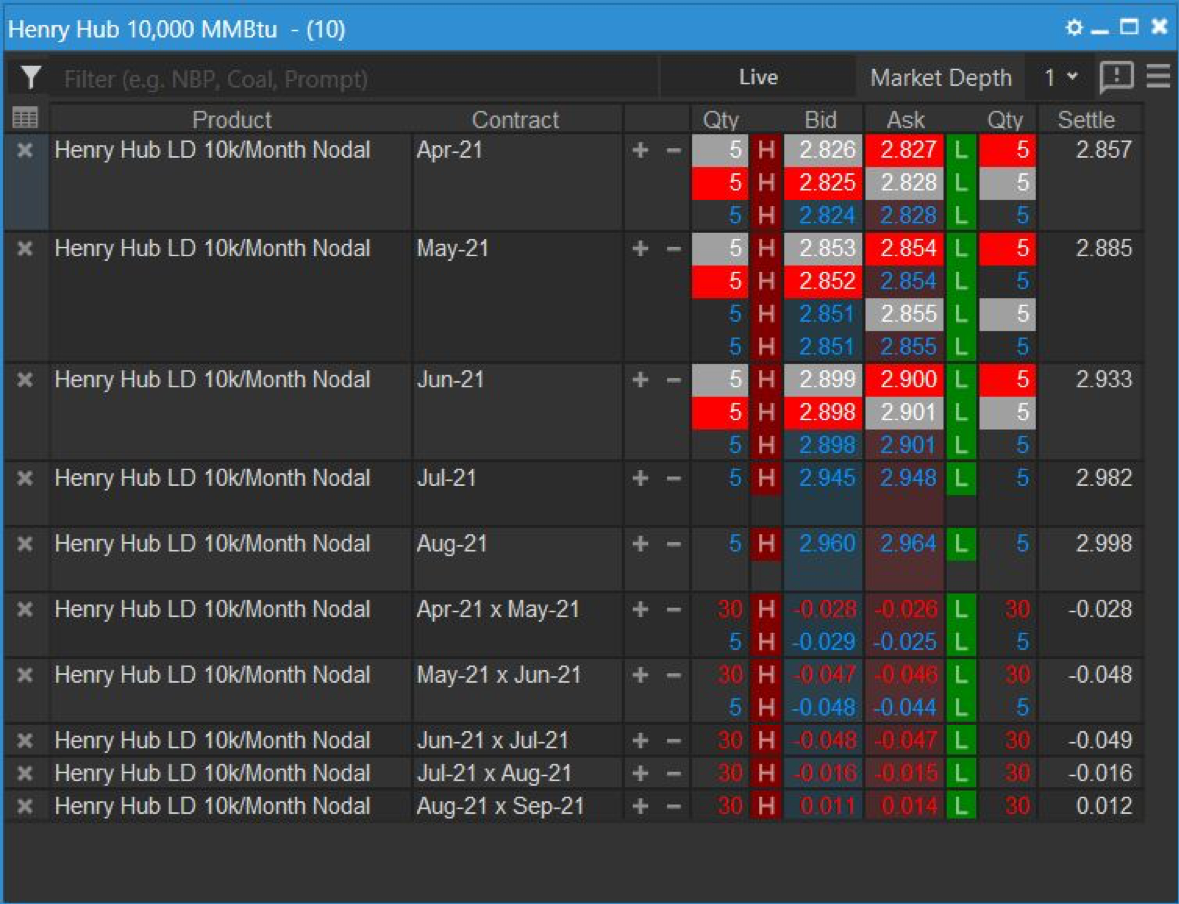

Nodal Exchange offers access to electronic markets in natural gas, power, and environmental futures. Above is a snapshot of our live markets for the Henry Hub 10k monthly contract for outrights, spreads, and strips which can be accessed via our front-end screen. In addition, we also offer the Henry Hub 2.5k per day contract for outrights, spreads, and strips. If you would like more information or access to this screen, please contact Energy Markets or call (703) 962-9820.

Nodal in the news

May 2021

Nodal Exchange achieves records in power and environmental futures

Learn more

April 2021

Nodal Exchange achieves multiple quarterly records in trading

Learn more

March 2021

Nodal Exchange achieves record market share in February

Learn more

About Nodal

Nodal Exchange is a derivatives exchange providing price, credit and liquidity risk management solutions to participants in the North American commodities markets. Nodal Exchange is a leader in innovation, having introduced the world's largest set of electric power locational (nodal) futures contracts. As part of EEX Group, a group of companies serving international commodity markets, Nodal Exchange currently offers over 1,000 contracts on hundreds of unique locations, providing the most effective basis risk management available to market participants. In addition, Nodal Exchange offers natural gas and environmental contracts. All Nodal Exchange contracts are cleared by Nodal Clear which is a CFTC registered derivatives clearing organization. Nodal Exchange is a designated contract market regulated by the CFTC.