Nodal Newsletter | April 2021

Nodal Highlights

NODAL EXCHANGE ACHIEVED MULTIPLE QUARTERLY RECORDS IN POWER AND ENVIRONMENTAL TRADING

Nodal achieved a quarterly trading record in power futures with volume of 559 million MWh in Q1 2021. In addition, environmental contract volumes on Nodal in Q1 totaled 58,065 contracts, up 54% from 37,698 contracts a year earlier.

Nodal power accomplishments in Q1 2021:

- Nodal achieved record power futures open interest with 1,041 million MWh per side at the end of the quarter representing 50.7% market share, which is a new record.

- Nodal Exchange achieved record power futures trading for March with 200 million MWh, representing 43% growth in March 2021 over March 2020.

- Nodal also set records for monthly power futures traded volume market share with 47.3% in the United States and 55.8% in the PJM market.

Nodal environmental accomplishments in Q1 2021:

- North American environmental contracts on Nodal achieved records in both traded volume and open interest. Open interest in environmentals ended the quarter at 123,200 contracts, up 89% from Q1 2020.

- Volumes in Q1 across the 56 REC futures and options contracts offered on Nodal rose to 54,421 contracts, up 111.3% from 25,748 in Q1 2020.

- Open interest at the end of Q1 across the REC contracts rose to a record 117,463 contracts, up 113.4% from 50,318 in Q1 2020.

NODAL ELECTRONIC TRADING

Nodal Exchange offers electronic trading in power, natural gas, and environmental products. The Nodal T7 Trading Platform can be accessed via industry leading web-based trading applications: CQG, Trading Technologies and Trayport. Please contact Nodal’s Account Management team with any questions.

HAPPY 12th ANNIVERSARY NODAL EXCHANGE!

Nodal celebrated its 12th anniversary on April 8. We want to thank our entire trading and clearing community for your support through the years!

Nodal Exchange achieves multiple quarterly records in power and environmental trading

Nodal achieved a quarterly trading record in power futures with volume of 559 million MWh in Q1 2021 (notional value of $15.5 billion per side). Nodal Exchange achieved quarterly trading of 579 million MWh in Q1 of 2020, but this included 74 million MWh related to the successful migration of power futures from NASDAQ Futures (NFX) in February 2020. Nodal Exchange also achieved record power futures open interest with 1,041 million MWh per side (equivalent to the electricity consumption of 98 million homes for a year in the USA) at the end of the quarter representing 50.7% market share which is also a new record.

Nodal Exchange also achieved record power futures trading for March with 200 million MWh, representing 43% growth in March 2021 over March 2020. Nodal also set records for monthly power futures traded volume market share with 47.3% in the United States and 55.8% in the PJM market.

Nodal offers access to electronic markets

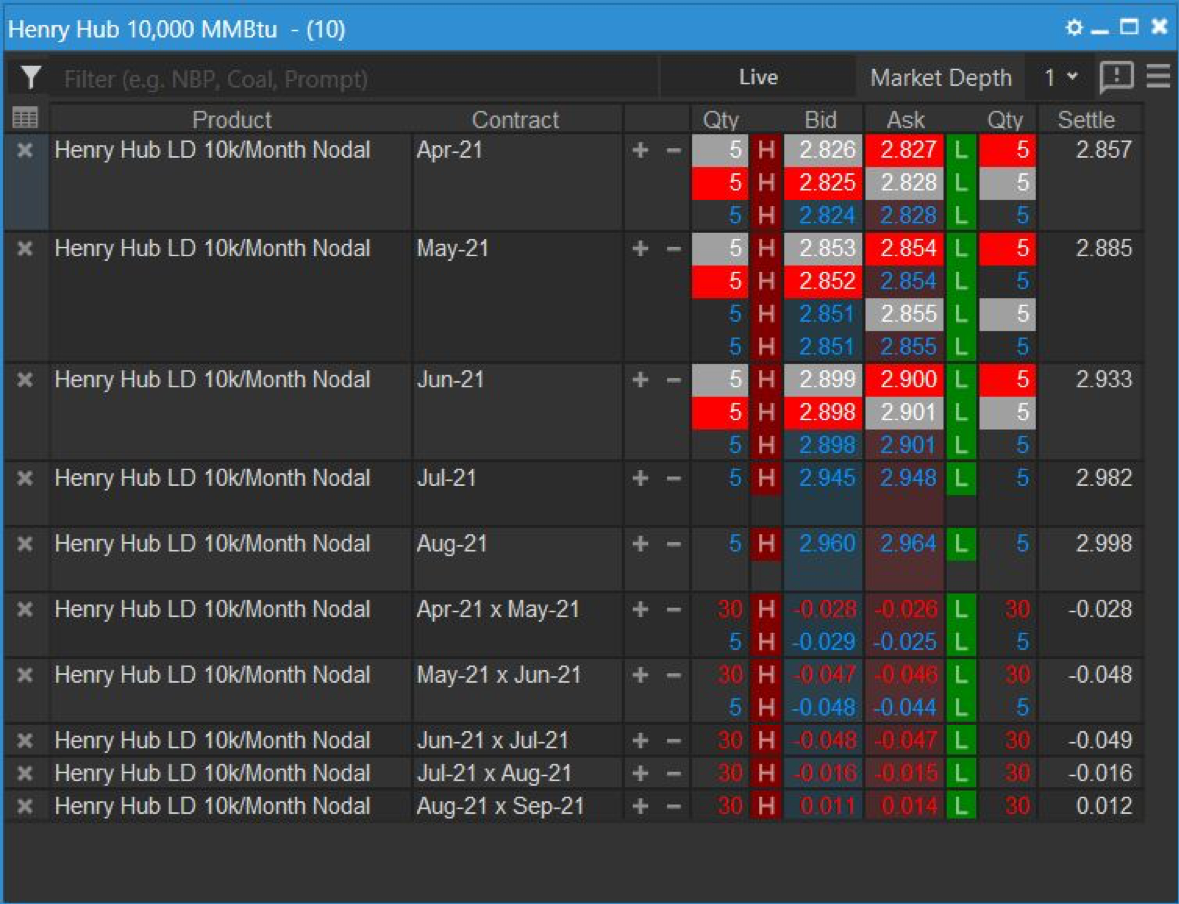

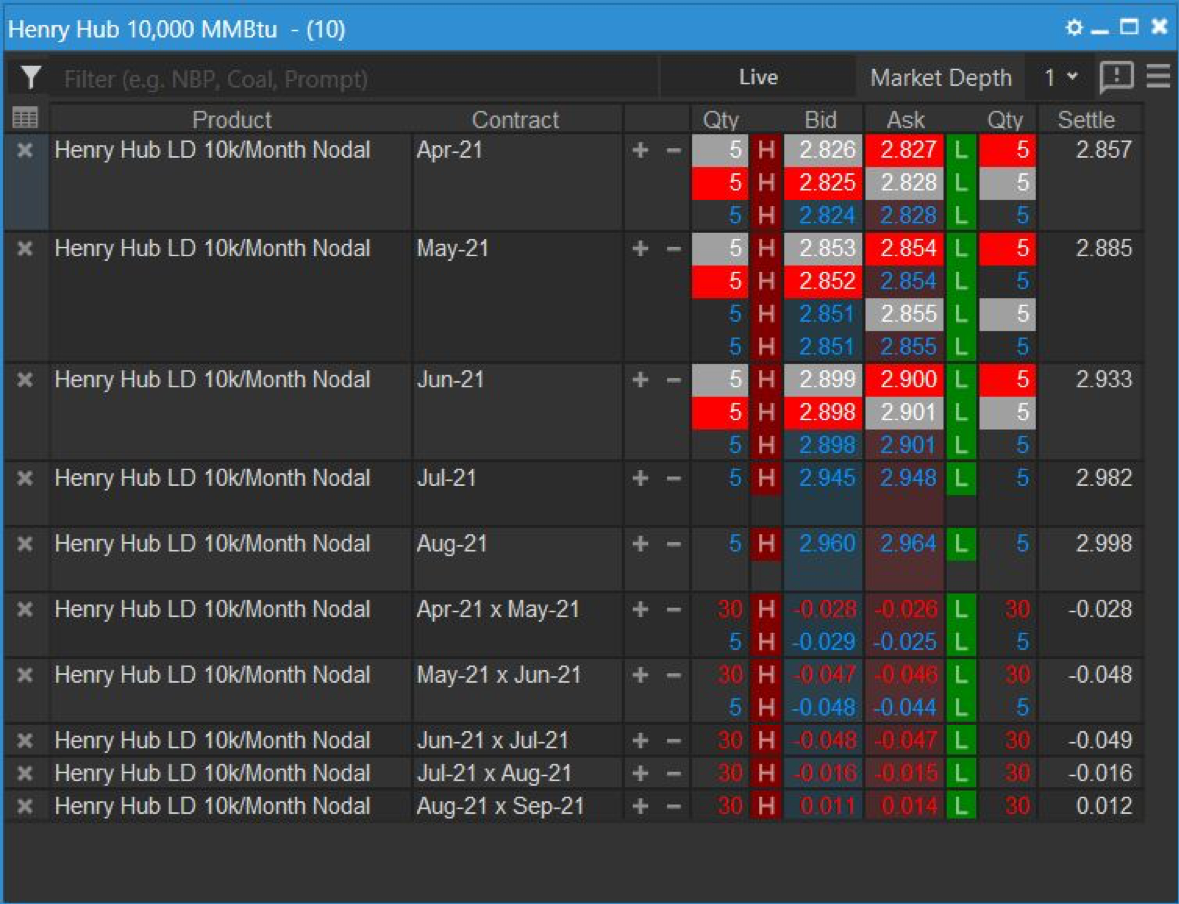

Nodal Exchange offers access to electronic markets in natural gas, power, and environmental futures. Above is a snapshot of our live markets for the Henry Hub 10k monthly contract for outrights, spreads, and strips which can be accessed via our front-end screen. In addition, we also offer the Henry Hub 2.5k per day contract for outrights, spreads, and strips. If you would like more information or access to this screen, please contact Energy Markets or call (703) 962-9820.

Happy 12th Anniversary Nodal Exchange!

Join us in celebrating Nodal Exchange’s 12th Anniversary! Thank you to our trading and clearing community for all of your support!

Upcoming Events

April 15

BUILDING MARKETS TOGETHER 2021 – Nodal Exchange will be attending EEX Group’s digital conference. On April 15, our CEO, Paul Cusenza, will be speaking in the panel discussion “Emerging from the crisis – what impact will politics and the pandemic have on the future of commodity trading?” For more information visit:

EEX Group Digital Conference 2021

May 26-27

NORTHEAST POWER AND GAS MARKETS VIRTUAL CONFERENCE – Nodal Exchange will be sponsoring the Northeast Power and Gas Markets Virtual conference. Our CEO, Paul Cusenza, will be chairing this event. For more information visit: Northeast Power and Gas Markets Virtual Conference For more information visit:

Northeast Power and Gas Markets Virtual Conference

Nodal in the news

March 2021

Nodal Exchange achieves record market share in February

Learn more

February 2021

Nodal Exchange sets daily trading record in power futures

Learn more

January 2021

Nodal Exchange achieved record year-end open interest

Learn more

About Nodal

Nodal Exchange is a derivatives exchange providing price, credit and liquidity risk management solutions to participants in the North American commodities markets. Nodal Exchange is a leader in innovation, having introduced the world's largest set of electric power locational (nodal) futures contracts. As part of EEX Group, a group of companies serving international commodity markets, Nodal Exchange currently offers over 1,000 contracts on hundreds of unique locations, providing the most effective basis risk management available to market participants. In addition, Nodal Exchange offers natural gas and environmental contracts. All Nodal Exchange contracts are cleared by Nodal Clear which is a CFTC registered derivatives clearing organization. Nodal Exchange is a designated contract market regulated by the CFTC.